At around the time I was about to turn 30, at the gentle urging of my parents and with a little help from them I entered the real estate market. Their advice was that real estate was always a good investment (something that now most people realize is not always true) and it’s better to own property and “pay yourself” via paying down a mortgage rather than “throw it away” via paying rent. I have my own thoughts on this way of thinking and I there are some points on which we definitely disagree. Regardless, I took their advice, accepted their help, and took the leap into home ownership. I’m glad I did and I will be forever grateful for their help and advice.

At around the same time I started saving money and investing in mutual funds. I met a financial advisor through a common acquaintance and he asked me if I would be willing to chat with him about investing and let him give me his spiel. I didn’t really need too much convincing. I always understood the benefits of saving and the magic of compound interest. Namely, that money invested today will earn interest, and that interest will earn interest, and so on and so forth meaning ultimately that even small amounts invested over time can accumulate and grow exponentially. Nonetheless, I let him give me his standard “why you should invest and why you should start today” presentation. There were a couple of things that he showed me that day that really made an impression.

One element of his presentation showed a line chart featuring different lines representing the growth rate of different types of asset classes over time, going back several decades. There was a line for cash (essentially what you would earn by putting everything in a checking account, or under your mattress), a line for stocks, etc., etc. The message was pretty straightforward: a person who invested their money in the stock market would be a gazillionaire while the person who stuffed his money under his mattress would be on the street holding a sign saying “will dance for food”, while wearing a barrel with suspenders. Relatively speaking.

The other element that really drove the message home was a hypothetical example comparing two pretend young people. Young person #1 (YP#1) understood the value of investing and the benefits of compound interest, and YP#1, who graduated from college at 21 and got a job was able to save $2000 per year, and invested that much every year over a period of approximately ten years or so, at which point we can assume that YP#1 became overwhelmed with living expenses and “life happening” and stopped saving altogether. Meanwhile, Young person #2 (YP#2) wasn’t really in a position to do the same thing at the young age of 21, and wasn’t able to start squirrelling away any savings until the ripe old age of 29 or 30, at which point YP#2 began to save $2000 per year, every year, until age 60. So when both YP#1 and YP#2 were 65 years old and ready to retire, who do you think had more money saved up? YP#1, who started early but only saved for about ten years before stopping, or YP#2 who saved for much longer but started ten years later?

Well if you guessed YP#1, then you understand the power of compound interest, and you would be correct. Mind you this hypothetical example was of course cooked up to drive home a point and it only works if you plug in the parameters just right, but they’re actually all pretty reasonable assumptions. I understood all this, but I also understood the moral of the story: I had to start saving right away. In fact, I was already almost certainly too late. But as the saying goes, better late than never, right?

Since I was about 30 years old at the time, a lot of my friends were in the process of making similar moves. This was around the time a lot of my friends started buying their own houses. But when the topic of savings and investing came up, I could see that it was far less common than buying property.

There were a few conversations with friends that I did have, however, and one in particular that stuck out to me. In this instance, one of my friends stated that being the owner of a new mortgage, he would rather pay down his mortgage aggressively and then at that point he would be in a position to save and invest. After all, “saving” was what you did when you had “extra” money left over, and if you were in debt, then no money was ever “extra” so long as you were in the red, right?

Two different approaches: simultaneous investing with mortgage payment vs focusing first on mortgage and investing after the mortgage is paid off. Which one is better? We can use math to find out!

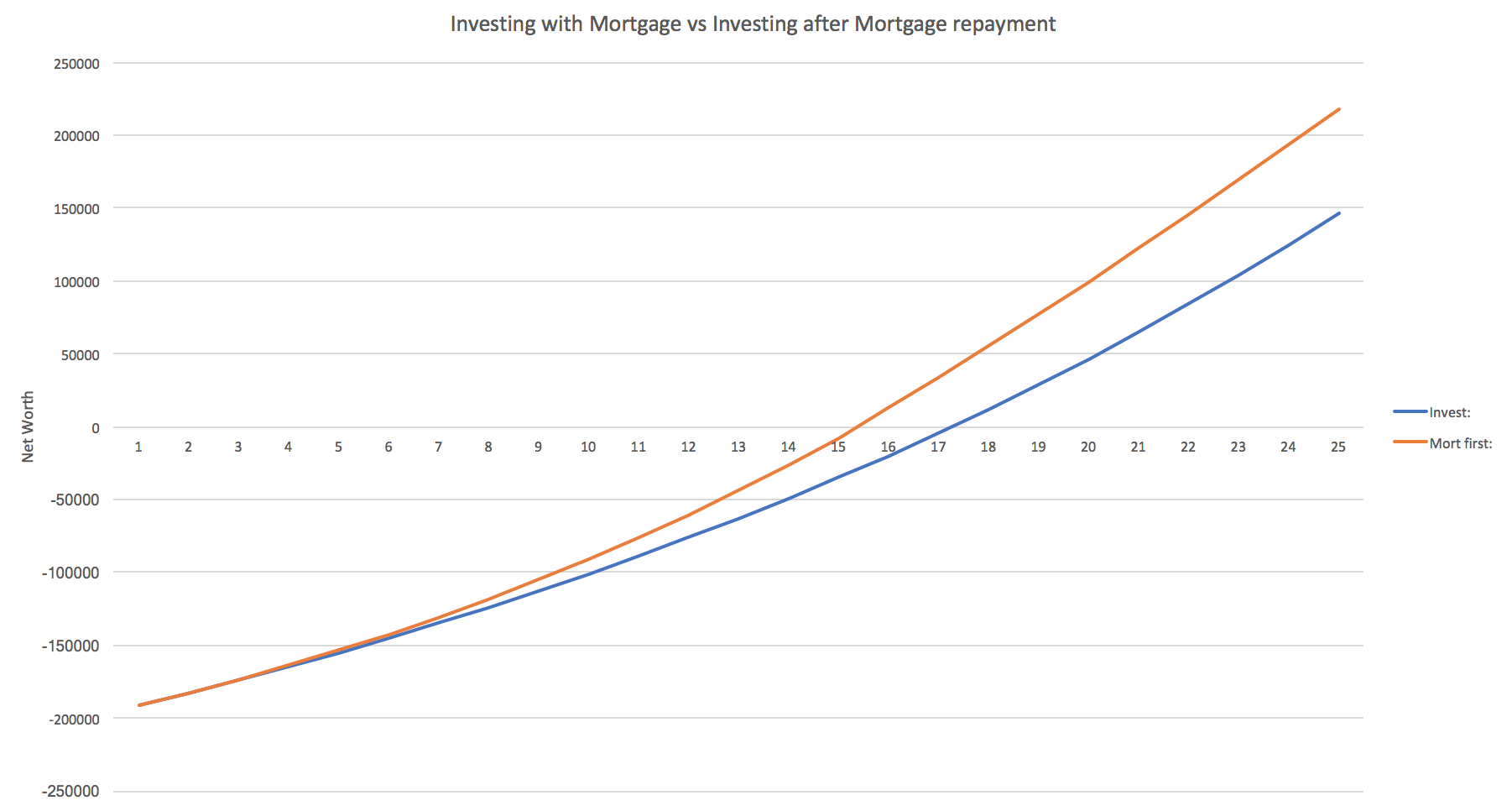

Let’s assume for our example here that we have a mortgage with $200,000 owing on it, and 25 years to maturity. Approach #1 will be what I actually did; mortgage payments based on the normal amortization schedule, and $400 a month or $4,800 a year invested at the same time. Approach #2 will instead take that $4,800 per year and pay down the mortgage faster. We will further assume that once the mortgage is paid off, each person will take the mortgage payment amount and add it to the investment amount for savings, so that total monthly savings will be constant over the 25 year period. For simplicity we will also assume a constant mortgage rate and a constant investment rate of return. What rates will we use? Based on rates over the past 10 years or so, 4% for a mortgage seems like a reasonable average, so we’ll use that. As for a reasonable investment rate of return, Mr. Money Mustache has a good explanation for why 7% seems like a reasonable but conservative estimate. And if I go back and look at my statements of my own investments over the past ten years, I can see that 7% is pretty close. So we’ll go with that.

The above chart shows Approach #1 (invest plus mortgage) in blue and Approach #2 (mortgage, then invest) in red. So we can see with this chart the relative performance of the two approaches and conclude that Approach #1 wins. Better to invest and earn 7% while paying off your mortgage than to pay the full mortgage off first and invest later.

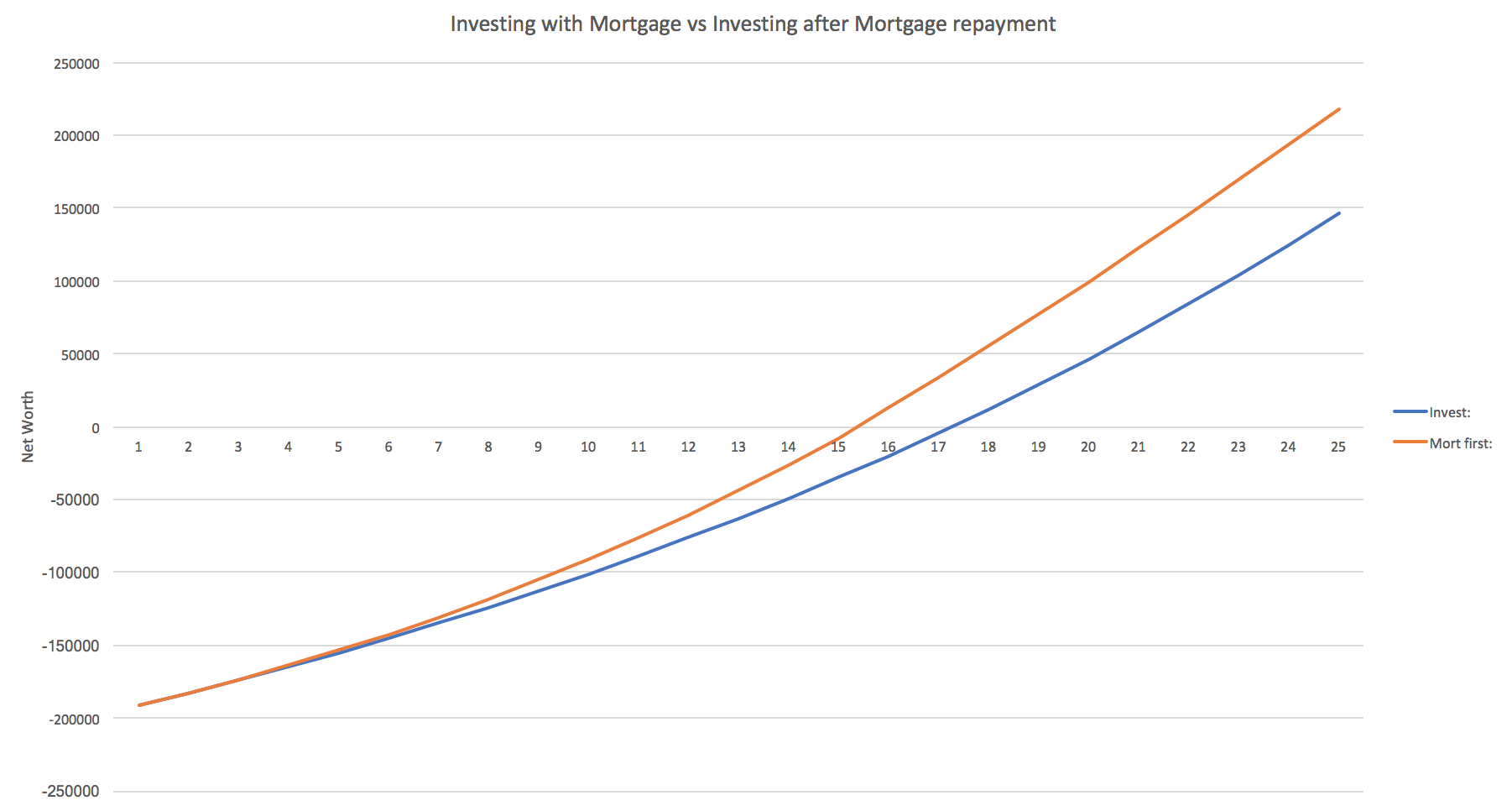

Okay, you might be saying, but what if your mortgage rate is higher than that? And what if your investments don’t earn 7%, but instead earn less? Good question. Let’s find out! My first mortgage was actually 6.05%, so we can use that for our second scenario. And let’s assume in this scenario that you’re saving your money in a savings account offered by your bank that’s only paying 2%. Now what?

In this case, paying off the mortgage first wins. Weird. Why the difference?

The difference all boils down to the two rates used in the calculation. If your mortgage rate is higher than what your investments are earning, then it makes sense to pay down your mortgage first. If your mortgage rate is nice and low, there’s a good chance you can do better by investing. Conceptually it helps once you realize that a mortgage, or any debt, is the same thing as negative savings. The interest rate you pay is the cost of the debt, and determines how quickly your debt grows, just like the interest rate earned on savings is the payment received for your savings and determines how quickly your savings grow. You may have also noticed that the blue line in the first chart reaches the highest value of all four lines between the two charts. That’s why; because it represents the highest interest rate. Simple enough.

This is why you always always always must pay down your high interest debt as soon as possible. Because if you don’t, the interest rate will keep you paying it off forever. If left alone, it can balloon out of control in no time. Likewise, an opportunity to earn high rates of return should not be overlooked.

“But how do you know what rate of return an investment will earn?” you might be asking. Fair question. Bonds will tell you exactly what sort of return you will be getting, as will low interest savings accounts, but it’s not like stocks, index funds, or mutual funds advertise their rates of return, because that is unknown. It’s true that most investment assets (including real estate) are volatile; sometimes they go up, and sometimes they go down. Depending on a number of factors (including luck), a portfolio can earn 30% over one ten year period but next to 0% or even go down over a different ten year period. That much is true. But while past performance is not necessarily indicative of future performance, we can get a pretty good idea of what to expect over the long term. And like Mr. Money Mustache explained ever so eloquently in the link posted, it turns out that 7% a year is a pretty reasonable, conservative estimate of what a balanced stock portfolio can earn, on average. It helps if you can stomach some losses in the short term just by reminding yourself that when things go down they usually go up afterward.

Everyone knows how much risk they can tolerate and how much of a gamble they think any form of investing might be, so I’m not about to give any universal advice that will apply equally to everyone. But I will say this: focus on chasing higher interest rates, both in the form of high interest debt repayment, and investing in higher interest earning assets, and you’ll probably do okay.